The stock would need to nearly quadruple in value to hit $1 trillion in market cap, but that might not be an unrealistic scenario.

Advanced Micro Devices (AMD -2.55%), also known as AMD, has been one of the hottest chip stocks in 2025, rising by 48% since the start of the year. It has been outperforming rival Nvidia, which is up around 33% over the same time frame (as of July 31).

But in terms of valuation, AMD is well behind its key rival. While Nvidia recently topped the $4 trillion mark in valuation, AMD isn’t even near $1 trillion. With a lower valuation and still a lot of growth on the horizon, is it only a matter of time before it joins the trillion-dollar club? And can it get there by 2030?

Image source: Getty Images.

AMD may be on the cusp of some tremendous growth

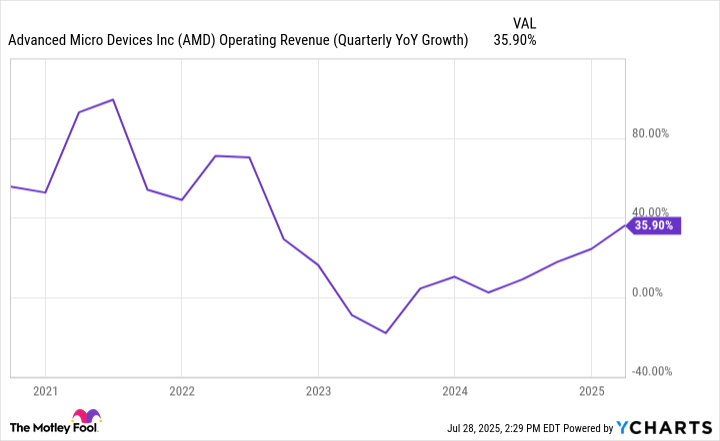

One of the reasons the company may be due to climb in value significantly — not just this year but in the future — is that its growth is finally starting to accelerate. For a while, it looked as though the chipmaker was falling too far behind Nvidia to convince investors that it’s a serious player in the artificial intelligence (AI) chip market. But with the launch of new AI chips and sales starting to take off, it’s winning over more growth seekers in the process.

AMD Operating Revenue (Quarterly YoY Growth), data by YCharts; YoY = year over year.

The company’s new MI400 chips even have the endorsement of OpenAI CEO Sam Altman, who is impressed with their specifications and plans to use the chips.

AMD’s CEO Lisa Su sees a lot of room for the company to take off, noting that its data center AI business generated $5 billion in sales last year and that in the coming years, it will grow to “tens of billions of dollars of annual revenue.” If that forecast ends up being correct, there’s no doubt that AMD’s value will rise sharply.

Can AMD quadruple in value?

Its market cap currently sits at around $280 billion. For it to reach $1 trillion, it would need to nearly quadruple in value from where it is today. That’s a big ask for the business, especially given that it trades at an astounding 131 times its trailing earnings. But there’s a bullish case to be made for why it can rally that much, despite it looking like a tall task.

First, as it scales up its AI business, the bottom line should improve. In fact, while the stock may look expensive at first glance, it’s trading at a price/earnings-to-growth multiple (PEG) of only 0.8. PEG is based on analyst projections of future growth, and a multiple of 1 indicates a good buy, and anything less than that suggests it’s cheap, which AMD looks to be.

Second, while Nvidia has soared by 1,600% in the past five years due to the AI hype, AMD’s stock has risen at an impressive but far more modest rate of 130%. I’m not suggesting it should have been doing as well as Nvidia, but investors appear to have been overlooking it, at least to some extent.

As customers potentially pivot to cheaper AI chips from AMD (and its growth rate remains high), it could conceivably be the better chip stock from here on out. It’s outperforming Nvidia this year, and this could be the beginning of a longer-term trend.

A lot still depends on the success of its new AI chips, but I can see a path for it to hit a $1 trillion valuation. If the company’s sales do indeed take off, as Su and analysts expect them to, then there could be a lot of room for the stock to run higher. I do think AMD will join the trillion-dollar club; it’s just a matter of when. If AI chip demand remains strong, I don’t think it’s unreasonable for it to happen within the next five years.

Is the stock a no-brainer?

The stock looks to be on a strong trajectory, and I do believe it’s a no-brainer buy at this stage. The company’s improved results are lining up with the hype from management and the excitement from Altman. The stock has largely been overlooked in recent years, at least in comparison with Nvidia, and now may finally be AMD’s time to shine.

Even if it doesn’t quite get to $1 trillion in the next five years, this still looks like a fantastic growth stock to buy right now.

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.